Explanation of FinTech Department Expansion for the 2025 Academic Year

———————————-- Reasons for Expansion:

- In response to the national and Financial Supervisory Commission’s FinTech Development Roadmap 2.0.

- Building on the department’s past success and reputation, recognized by regulators, innovation hubs, startups, and financial institutions.

- Focusing on data-driven education aligning with policies on data governance and big data/data science innovation.

- Developing interdisciplinary connections between data-driven applications and regulatory tech/legal tech as the foundation of RegTech development and employment.

- Responding to expectations from students, faculty, and high school teachers/parents.

- Fulfilling the mission of cultivating FinTech talent for the nation.

- Track Structure: The department will be divided into two tracks:

- “Innovative Technology & Big Data Applications Track”: In response to global industry needs for big data analytics, interpretation, and strategic data-driven decision making.

- “Digital Regulation & Tech Law Track”: Focused on RegTech and LawTech development. Emphasizes creating legal/regulatory frameworks for emerging fields such as AI, crypto, inclusive finance, and designing balanced, consumer-oriented innovations.

- Educational Philosophy: Based on a three-pillar approach — Digital Finance, Innovative Tech, and Tech Law — students are trained to become:

- Innovative Digital Financiers

- Financial Scientists

- Tech-Legal Experts

- FinTech Foundations

- Economic & Financial Analysis

- Information Technology & Data

- Media & Markets

- Law & Regulation

- Teaching Methodologies:

- Cross-Disciplinary Integration: Theory, hands-on practice, tech foundations, and applied learning to develop core competencies in FinTech, analysis, teamwork, ethics, global vision, and inclusive finance.

- Digital Experimentation: Partnership with FinTech Innovation Park to create a sandbox for validating student ideas and accelerating market applications.

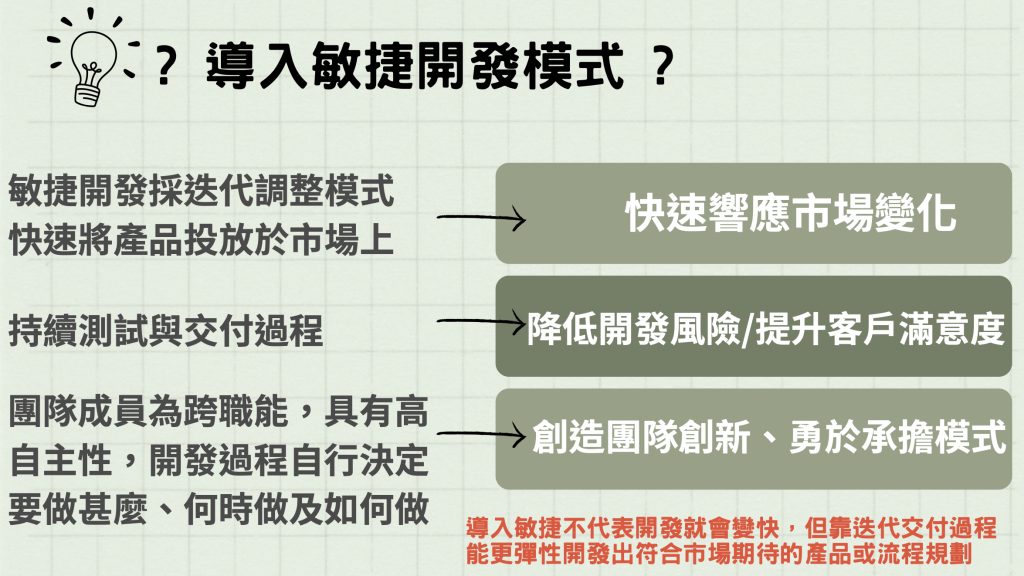

- Entrepreneurship Design: Introduce design thinking, agile development, lean startup, and flipped classrooms to prepare students for real-world disruption and innovation.

- Workshops: Integrate APIs in sandbox environments for practical workshops, enabling real entrepreneurial simulation and business building.

- Future Career Pathways:

- Academic Advancement: 3rd-year students can apply for a 5-year integrated master’s program in FinTech, balancing full-time internships and graduate studies at Taipei campus.

- Employment Fields: Electronic payments, crypto, blockchain, AI, smart investment, banking, insurance, securities, RegTech/LegalTech, and innovation sectors.

- Career Map:

- Graduates can become multi-skilled professionals for jobs such as next-gen FinTech scientist, digital banker, financial service personnel, FinTech compliance officer, data scientist, AI expert, security engineer, agile marketer, algorithm developer, e-commerce producer, and RegTech specialist.

- Detailed Career Paths:

- FinTech Scientist: Combines theory and application in IT, finance, law, and marketing for broad analytical and regulatory roles.

- Digital Financier (Neo-banking): Trained for emerging roles in internet/digital banks through internship-to-employment pathways.

- Digital Financier with Tech Mindset: Suited for roles in traditional and future financial institutions, aligned with FinTech and trust certifications.

- Regulatory Technology Specialist: Focuses on compliance, AML certifications, and RegTech development.

- Tech-Legal Expert: Trained with 20+ law credits to qualify for the bar and work in crypto law, compliance, or legal research. Cross-disciplinary training enables work in both traditional and emerging sectors.