About the FinTech Program (Department of Financial Technology Applications)

———————————-- Program Goals: The department offers a tri-core curriculum in Innovative Finance, Emerging Science, and Tech Law. It aims to cultivate students into:

- “Innovative Digital Financiers” (Digital Finance)

- “Financial Scientists” (Emerging Science)

- “Tech-Legal Experts” (Technology & Law)

- Academic Advancement: Third-year students can apply for the 5-year integrated master’s program in FinTech (Taipei Campus) and take master-level courses while doing job internships arranged by the department. Students attend classes at night while working full-time during the day.

- Career Fields:

- Tech industry: E-payments, virtual currency, blockchain, AI, big data, robo-advisors

- Financial industry: Banking, insurance, securities, regulatory agencies, digital finance

- Innovation in financial service development

- RegTech & LegalTech fields, with dual expertise in legal and tech domains

- Application in traditional and existing industries

- Career Outlook: Graduates can pursue careers such as:

- Next-gen FinTech Scientist

- Neo-bank & digital banking specialist

- Financial tech compliance officer

- Data/Big Data Scientist

- Asset management and AI professionals

- Security expert, agile marketer, algorithm engineer, livestream producer, RegTech specialist

- Academic & Industry Pathways:

- FinTech Scientist: Focused on theory, practice, and application in areas like Info & Tech, Econ & Finance, Media & Market, and Law & Regulation.

- Digital Financier (Neo/Internet Bank): Training to fit digital/neo-bank structures, integrated with internship pipelines.

- Digital Financier with Tech Thinking: Adapted for traditional and modern financial institutions with certification paths like FinTech proficiency and trust planning.

- Legal Specialist in FinTech: Equipped for AML, legal compliance, and digital regulation roles.

- Tech-Legal Expert: With 20+ credits in law, students can qualify for bar exams and pursue legal practice in traditional and emerging sectors like virtual assets.

- Teaching Methodology:

- Cross-Disciplinary Learning: Blending theory and practice across finance, tech, and law, cultivating competencies in problem solving, communication, teamwork, ethics, and global/inclusive finance.

- Digital Sandbox: Collaboration with FinTech innovation parks to turn ideas into validated projects through field testing and mentoring.

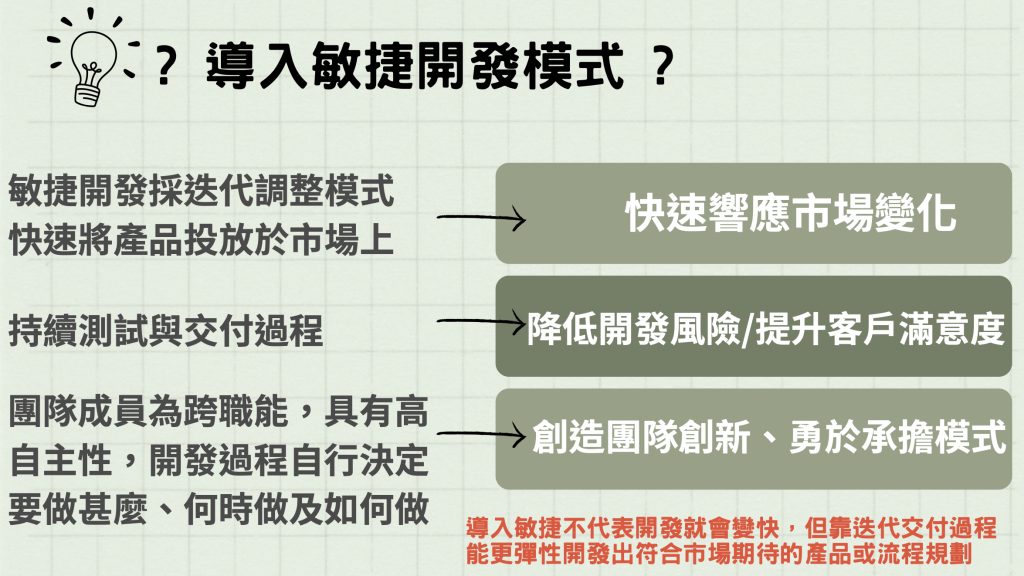

- Design Thinking & Agile: Students apply design thinking, lean startup, and iterative testing in flipped classroom settings for real-world FinTech innovation.