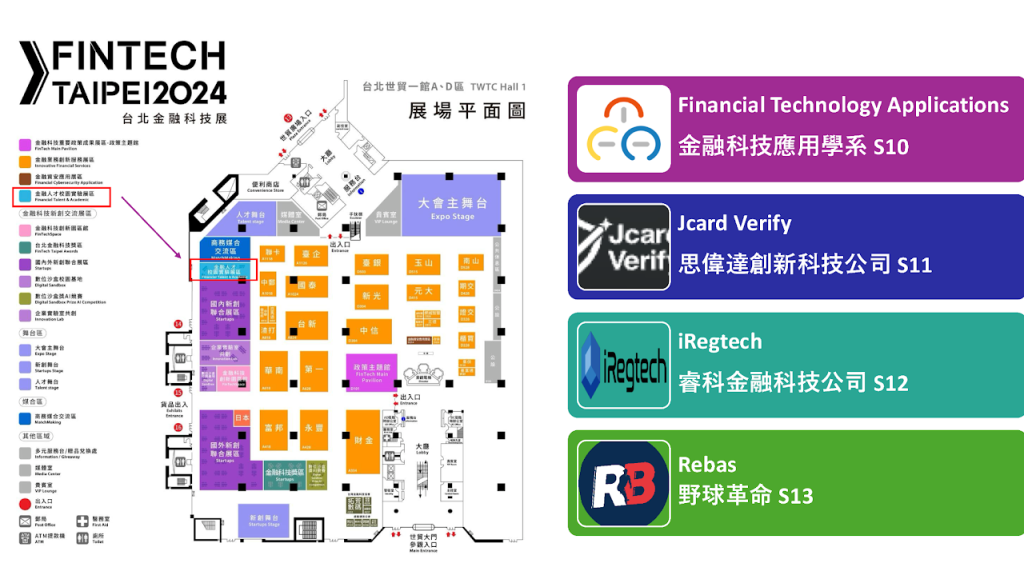

- Department of Financial Technology Applcations:

- The Department of Applied Financial Technology cultivates students with innovative foundations, innovative cross-domain integration capabilities in digital finance, information science, media markets, and legal supervision, and helps them become “financial technology legal experts” and “innovative financial scientists.” Upon graduation, students will obtain the credit courses and professional certificates of “Innovation Technology and Big Data Application Group” and “Digital Supervision and Technology Law Group”. They will have internships in enterprises in their fourth year and complete graduate studies in their fifth year. Internships mean employment, so they can combine work and academics.

- The department builds a financial technology platform based on data-driven, introduces innovative processes such as design thinking, agile development, and iterative testing, and cooperates with financial institutions and financial technology companies to offer courses, and cooperates with the digital sandbox campus demonstration base in the financial technology innovation park. , carry out innovative cross-domain integrated learning and internship employment, so that various innovations can be verified and implemented in practice.

- STARBIT:

- “Blockchain anti-fraud solution – Jcard Verify platform”: Combining AI and zero-knowledge proof, it helps consumers to check and identify on the platform before contacting or investing in any digital assets, or give ratings to help other potential investors People, improve the authenticity and security of virtual assets.

- iRegtech:

- Combining blockchain data with automated analysis helps the government and industry to jointly combat fraud, money laundering and financial crimes. By assisting industry to develop professional criminal investigation software and providing judicial education and training courses, it connects with Ming Chuan University’s virtual asset Courses and certification guidance to increase financial technology literacy, reduce the digital divide, and protect consumer rights.

- Rebas Baseball Revolution:

- The REBAS Baseball Database seamlessly integrates data and images, allowing all fans and anchors to quickly search for competitive performance through easy-to-understand visual charts, or using multiple filtering conditions and intuitive interface design to allow … Players and coaches can conduct tactical intelligence gathering and formulate combat strategies. This also includes using algorithms to analyze players’ potential value and reasonable salary ranges to assist in healthy communication between teams and agencies. The comprehensive introduction of sports technology and the reduction of the learning curve will enable the sports ecosystem to continue to develop in the technological era.

2025 Employment Planning and Preparation in the Financial Industry

Topic: Employment Planning and Preparation in the Financial Industry Date: 2024/03/25 (Tue) 12:50-14:50 Speaker: Mr. Shi Han-Guang, Manager at Hua Nan Bank (Alumnus) Location: FinTech