- Exam Information:

- Important Dates:

- First Stage Screening Result: 2025.03.27

- Notification of Designated Item Evaluation: 2025.03.27

- Second Stage Registration Period: 2025.04.09 9:00 to 2025.05.05 15:30

- Payment Deadline: 2025.04.09 9:00 to 2025.05.05 15:30

- Designated Item Evaluation Dates: 2025.05.17 to 2025.05.19

- Result Announcement: 2025.05.28 14:30

- Final Grade Review Deadline: 2025.05.29

- Program Preference Submission: 2025.06.05 to 2025.06.06 (9:00–21:00 daily)

- Unified Placement Result Announcement: 2025.06.12

- Registration System: https://tea.mcu.edu.tw/enrollmcu/Proj_Index.aspx

- Review Document Guidelines: https://reurl.cc/M6qGRm

- Important Dates:

- FAQs Collection: https://reurl.cc/L5RZ4x

- Self-positioning: Since its establishment, our department has aimed to cultivate interdisciplinary professionals with broad foundational knowledge and in-depth expertise in applying FinTech to solve management problems. We emphasize a balance between theoretical education and practical training, developing students’ creativity, problem-solving abilities, teamwork, diversity, and global perspectives.

- Educational Objectives

- Train FinTech professionals: Equip students with international perspectives and trend awareness, and foster innovative integration capabilities in FinTech.

- Strengthen theoretical foundation and practical training in FinTech: Provide knowledge and training for acquiring FinTech certifications.

- Build teamwork and expand international vision: Improve language skills; cultivate responsibility, teamwork, honor, and service through internalized character education.

- Develop professionalism and service passion: Correct use and practice of FinTech, inclusive finance, microfinance, and social responsibility.

- Core Competencies

- Professional FinTech capabilities

- Analytical thinking and problem-solving

- Communication and teamwork skills

- FinTech ethics recognition and practice

- Global vision and local revitalization ability

- Multicultural communication and expression

- Career Paths

- Entry-level FinTech practitioner

- Innovative financial expert

- Market analysis consultant

- FinTech expert (Innovation Technology & Big Data track)

- Legal tech expert (Regulatory Technology & Digital Law track)

- AI scientist

- Course & Career Mapping: Department Curriculum Map

- Department Intro Videos

- Highlights: https://www.youtube.com/watch?v=y8t5IZTIeNg&t=2s

- Campus Environment: https://www.youtube.com/watch?v=bG2RePZ-JY8

- Courses: https://www.youtube.com/watch?v=TpfSHU8QACo

- Student Experience: https://www.youtube.com/watch?v=QY75ZsObRlI

- Faculty Dialogue: https://www.youtube.com/watch?v=KwQta7lKTuY

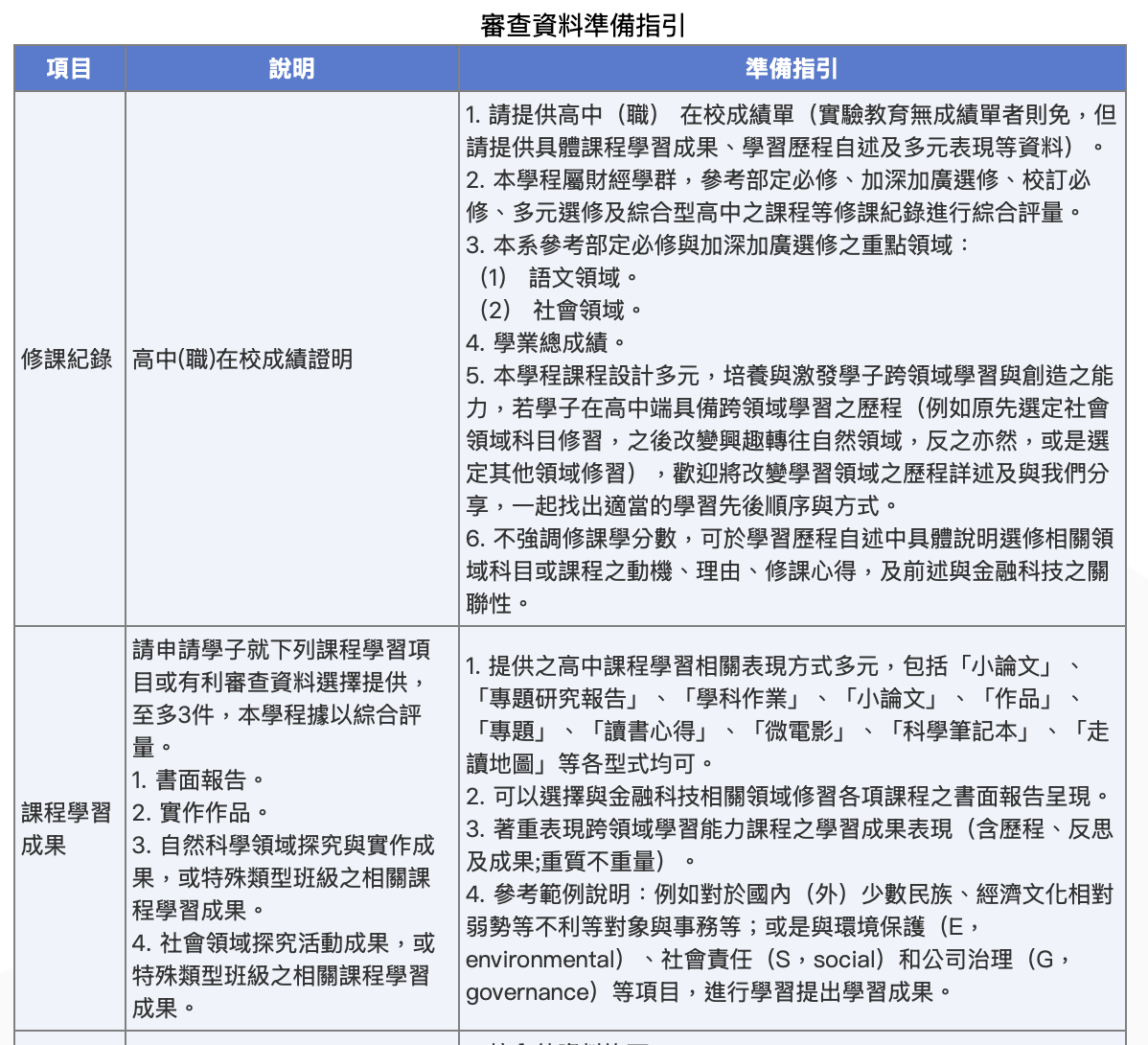

- Guidelines for Application & Review Documents (Slides): https://drive.google.com/file/d/1FwqKxp507IxM0WMjoLoxAIuVJrhX5cF0/view?usp=drive_link

- Learning Portfolio & Essay Topics – AI: https://sites.google.com/view/xuan2025/學生研究論文?authuser=0

- Learning Portfolio & Essay Topics – Virtual Assets: https://sites.google.com/mail.mcu.edu.tw/fintech-education-ecosystem/首頁?authuser=0

- Current Affairs & Hot Topics – Digital Learning: https://fta.wp.mcu.edu.tw/knowledge-base/digital-course/

- Legal & Risk Issues of Taichung Gas Explosion: https://www.youtube.com/watch?v=vtJ151RezrE

- Recent Events & Emerging Tech Videos:

- Donald Trump gives major investment announcement

- President Trump and Ukrainian President Zelenskyy in Oval Office, Feb. 28, 2025

- How AI Reshapes Education | What Is the Real Question? | Yi-Ling Wen | Humanities Forum | Full Episode 20250215

- Using Humanities to Harness AI | Rules for Surviving the AI World | Shih-Chia Cheng | Humanities Forum | Full Episode 20250208

- Creating Positive Emotions with VR | Virtual Reality & Happiness | Ri-Hsuan Lin | Humanities Forum | Full Episode 20250301